How Much Does It Cost To Develop An App Like Tabby Card?

How Much Does It Cost To Develop An App Like Tabby Card?

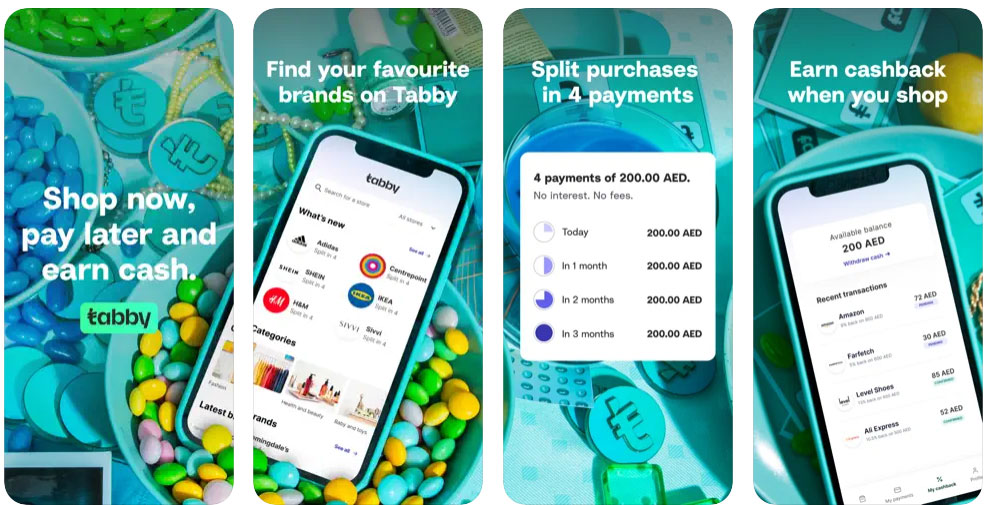

Shop online, buy products now, but pay later!

A crazy concept, right.

Tabby App is one of such amazing online shopping app with buy now pay later concept. Established in 2020, Tabby has declared that it has over 1.5 million active users in Saudi Arabia, the United Arab Emirates (UAE), Bahrain, and Kuwait.

Unlike traditional e-commerce apps with multimode payment facility, Tabby allows its users to split their payments in 4 consecutive 4 interest-free payments.

Tabby and Tamara-like buy now pay later mobile applications are creating a buzz in the UAE’s e-commerce sector. Multinational e-commerce stores like AliExpress, Shine, and Amazon are encouraging Tabby services in the UAE and other countries.

Tabby-like popular FinTech solutions for Android and iOS in Dubai, UAE, with interest-free payment options for purchases of over SR 100 and up to SR 3,000 are providing outstanding shopping experiences to the users.

Hence, users of Tabby Android or iOS app can buy at online stores and add any debit or credit card to the Tabby app for paying installments smoothly.

If you are looking ahead to offer something unique services to your audience and extend your brand credibility, invest in Tabby-like FinTech apps development.

In this article, to help companies that are interested in Tabby clone mobile app development, we have given a detailed guide on:

- How does Tabby mobile app works?

- What features and functionalities you must add to your tabby-like online payments app?

- What are the benefits of Tabby clone apps development?

- Best FinTech App Monetization Strategies

- How must will it cost for Tabby-like trending buy now pay later application development?

How Does Tabby Mobile App Works?

Tabby App- A Top FinTech App In UAE

Tabby is one of the best Fintech apps in the UAE, Saudi Arabia, Kuwait, and Bahrain. This Dubai-based Fintech application let customers shop at their favorite brands and break their total payments into 4 equal installments at a 0% interest rate.

Tabby-like the best online shopping app allows users to surf favorite brands and explore a range of product categories (including, Fashion, Beauty, Home, Gifts & Gadgets, Baby & Toys, Travel & Tourism, and Sports & Gaming) as per their needs.

The app is designed in a way that users can view cashback deals of brands, visit an online store, make purchases, and get attractive cashback as promised upon getting approvals from the stores.

Hence, the Tabby-like popular online payment app ensures faster, easier, convenient, and hassle-free payment services.

Currently, this UAE’s famous mobile app is available to download from Google Play Store and Apple App Store for Android and iOS users. It has acquired a 4.7/5 star rating from both active app users of Android and iPhone.

Recommend To Read: How Much Does IT Cost To Develop An App Like Talabat?

What Features That You Must Add To Your Tabby-like Easy Online Payments App?

Tabby is attracting millions of Android and iPhone users with its user-friendly and easy-to-use features. Here are the best features of this successful UAE digital app. Tabby-like an easy online shopping and payments application development needs to be integrated with these unique and out-of-the-box features to ensure quick success.

-

Perfect App Size

Since Tabby is developed with the perfect size, the download process will take less time. Hence, the application will be downloaded faster. Hence, make sure of developing an app that consumes less space in the user devices and downloads faster.

-

Quick app accessibility

Tabby is the best online payments app that runs seamlessly on Android and iPhone. Its simple app registration and login module is the first reason for rapid installation. This best digital payment app in Dubai, UAE is offering quick app accessibility.

Users can sign up for the app by just verifying their mobile number and e-mail ID. So, Tabby asks for phone number and sends a secure OTP code to sign and access the application functionality.

-

Easy To Navigate Home Page

Tabby’s home page gives one-click access to popular brands and deals that ensure hassle-free online shopping experiences. Moreover, the search bar on the top of the home page will let users search for their favorite brands and make their purchases smoothly.

-

Shop By Category

It is a user-friendly feature that allows users to shop by category at their favorite stores. The top FinTech application in the Middle East, the Tabby app facilitates users to shop a range of products such as fashion, beauty care, toys, baby essentials, home essentials, gifts & gadgets, and many more from thousands of listed brands.

Hence, the integration of this kind of user-friendly feature in Tabby clone apps in the UAE will improve shopping experiences.

-

Easy Check Out Process

Tabby is the best online shopping platform in the UAE. Users can shop by brands and choose tabby for splitting the total order amount into four easy installments. The app automatically debits the amount as per scheduled dates. Make sure to design a simple checkout page that allows users to check the how view amount to be paid in a single installment.

Get a free quote for Fintech App Development!

-

Track Order

It is a must-have feature of any online shopping or payment application. Tabby-like popular online shopping applications allow users to track their orders by clicking gently on the Track Order button.

-

Split Into 4

Split into 4 means that the users shop at brands they love and split their payments into 4 easy-to-pay installments at zero interest rates. No hidden fees or interest would be charged for installments. Tabby has gained popularity over Tamara (the best alternative to Tabby-like popular FinTech app) for this feature in the country.

-

Deals & Cashback Offers

Users of the tabby mobile app can access the deal and cashback in simple clicks and earn real money. Users can get attractive cashback from the brands and redeem them or withdraw cash with ease. It is the best loyalty program offered by Tabby-like the most-used buy now pay later application in the UAE, Middle East.

-

Push Notifications

Push notifications feature enables brands to send featured products and the best deals to the selected app users. Leading online e-commerce brands that were partnered with Tabby can also send push notifications regarding orders, arrivals, and payments.

These all a few must-have features of Tabby like the best online shopping platform for Android and iOS. Push notifications feature will also sends EMI due dates and allow users to stay on top of their payments.

Would you like to develop Tabby-like a leading FinTech Mobile App?

Let’s talk to our app development consultants and get precise budget quote instantly!

What Are The Benefits Of Tabby Clone Apps Development?

Buy Now Pay Later Apps development is a hot topic in the global FinTech industry. FinTech companies or loan lending organizations are switching to Buy-Now-Pay-Later mobile application development.

Advantages of Tabby-like popular Fintech application Development:

- Buy now pay later apps offers faster, convenient, quick access EMIs.

- Users can split bills and pay easily on a monthly basis.

- Allow users to get quick access to payment breakdowns and improve customer retention.

- Zero cost EMI with particle down payment facility will increase brand reliability.

- Online shopping brands in partnership with Tabby-like Fintech apps can surge sales conversions.

- Guaranteed and Attractive cashback and deals will increase the app downloads and installations.

- Fintech apps with buy now pay later facility has high scope over traditional e-commerce or finance solutions.

- Buy now pay later apps act as credit cards, so businesses can generate additional revenues from customers upon breaking the EMI scheduled dues.

- Businesses can build strong customer loyalty.

- Attract and improve customer experiences and generate higher sales

- Zero risk for e-commerce players by partnering with buy now pay later service providers.

- Overall, the increasing popularity of Buy Now Pay Later applications will benefit FinTech apps owners.

Best FinTech App Monetization Strategies

- Custom FinTech app owners can demand commissions from brands as registration charges.

- Tabby-like popular buy now and pay later like service providers in the UAE are generating additional amounts from brands on every purchase

- Buy now pay later apps owners can charge brands to feature their products or brand name

- EMI bounce charges is another best way to generate additional amount from the app

These are four proven finance app monetization strategies that offer a continuous flow of money from Tabby-like digital payment applications.

Recommend to Read: Top Mobile App Development Companies in Dubai, UAE

How Much Will It Cost For Tabby-like Buy Now Pay Later App Development?

Hyena, the best mobile app development company in Dubai, UAE, has a vast proven experience in mobile software development. We estimate that the development cost of an online payment solution on either Android or iOS will cost around $35,000-$60,000 with mid-level UI complexity.

However, the cost of a full-fledged Fintech app for Android and iOS with in-app calling, chatting, and location tracking like advanced features will go beyond $150,000.

Hyena, the best mobile payment apps development company in the Middle East, with full-stack software developers, builds bespoke native or hybrid or cross-platform FinTech apps at an attractive budget.